After the 2024 Private Attorneys General Act (PAGA) reform, the California Department of Industrial Relations (DIR) published frequently asked questions (FAQs), including information on who can bring PAGA claims, what can be recovered in a lawsuit, the cure process and settlements.

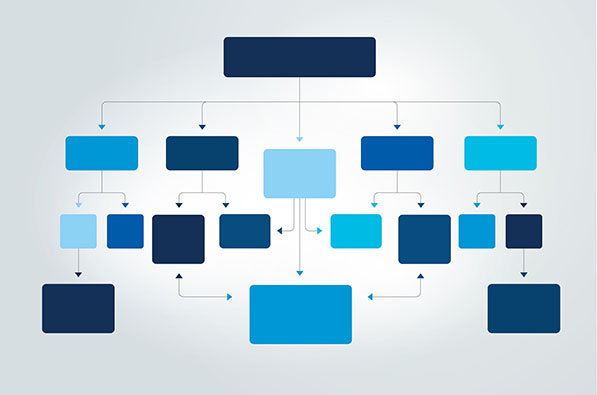

Recently, the DIR updated its PAGA FAQs, adding four new flow charts visually explaining the administrative process for filing and investigating claims, as well as the cure process available to small employers and the wage statement cure process for all employers.

Understanding the PAGA Filing and Investigation Process

Before an employee can file a PAGA lawsuit, they must submit written notice of the alleged Labor Code violations to the Labor and Workforce Development Agency (LWDA), pay a filing fee and provide notice by certified mail to the employer. Although not required, an employer may respond to a PAGA notice by submitting a response to the LWDA.

The written notice requirement gives:

- The LWDA the opportunity to investigate the alleged violations; and

- The employer notice of the alleged claims so the employer can decide whether to respond to the notice and/or to “cure”, if the violations alleged are subject to cure.

The LWDA assigned responsibility for investigating PAGA notices alleging wage and hour violations to the Labor Commissioner’s Office (LCO) and responsibility for investigating PAGA notices raising health and safety violations to the California Division of Occupational Safety and Health (Cal/OSHA).

For wage and hour violations, if the LCO intends to investigate a PAGA notice, it will notify the employee and the employer within 65 days of the PAGA notice filing. Then, the LCO has 120 days to complete its investigation and file a lawsuit or issue a citation. If it does, the employee may not file a PAGA lawsuit based on the same facts and theories contained in the LCO’s citation or lawsuit. If the LCO does not file a lawsuit or issue a citation within 120 days, the employee can proceed with a lawsuit. If the LCO does not give notice within 65 days that it intends to investigate, the employee can file a lawsuit.

The filing and investigation process for wage and hour PAGA claims is illustrated in the PAGA Notice and Investigation Procedures (Labor Code Violations Subject to the Jurisdiction of the Labor Commissioner’s Office [Lab. Code, § 2699.3, subds. (a), (c)]) flow chart.

For health and safety violations, Cal/OSHA must investigate any PAGA notice within six months of the alleged violations and can issue a citation to the employer. If Cal/OSHA issues a citation, the employee cannot file a PAGA lawsuit; if it does not issue a citation, the employee can appeal the decision in court or file a PAGA lawsuit.

The filing and investigation process for health and safety PAGA claims is illustrated in the LWDA PAGA Procedures — Safety and Health Claims (Cal/OSHA Investigation Procedures [Lab. Code, § 2699.3, subd. (b)]) flow chart.

Expanded Cure Options

PAGA reform expanded the scope of claims that employers can “cure” after receiving a PAGA notice to include not just wage statement claims but also claims for minimum wage, overtime, meal and rest breaks, expense reimbursement, and more. In response, the LWDA established a separate PAGA unit to administer cure procedures.

Small Employer Cure Process

If an employer had less than 100 employees during the one-year period before the filing of a PAGA claim, it’s considered a “small employer” and can take advantage of the small employer cure process by submitting a confidential proposal to cure certain types of violations. The proposed cure needs to correct the violation alleged by the employee, bring the employer into compliance with the Labor Code sections identified in the PAGA notice, and make each aggrieved employee whole, which may require paying employees for unpaid wages and expenses, as well as interest, liquidated damages and attorney’s fees and costs.

The “Small Employer Administrative Cure Process” is illustrated in the LWDA PAGA Cure Procedures (Small Employer Cure Process [Lab. Code, § 2699.3, subd. (c)(2)]) flow chart.

Wage Statement Cure Process

Employers of all sizes can attempt to cure alleged violations of Labor Code section 226’s wage statement requirements. An employer may cure a wage statement violation using this process by taking certain steps to provide aggrieved employees with the required wage statement information and then giving written notice to both the LWDA and the employee that it has cured the alleged violations.

The “Wage Statement Administrative Cure Process” is illustrated in the LWDA — PAGA Cure Procedures (Wage Statement Cure Process [Lab. Code, § 2699.3, subd. (c)(3)]) flow chart.

Under both Small Employer and Wage Statement processes, if the LWDA determines an employer has successfully cured an alleged violation, the employee may not file a PAGA lawsuit asserting that violation.

Employers can find information about the specific requirements for each cure process in the LWDA’s PAGA FAQs.

Capping Penalties Through Compliance

Remember, under PAGA reform, the potential civil penalties an employee can recover may be capped if an employer takes “all reasonable steps” to comply with the law. If you proactively take all reasonable steps to comply with the law before receiving a PAGA notice, then the maximum civil penalty is capped at 15 percent of the penalty sought. If you begin taking all reasonable steps towards compliance within 60 days after receiving a PAGA notice, the maximum civil penalty is capped at 30 percent of the penalty sought. [TD1]

To help employers take “reasonable steps” towards compliance with California’s wage and hour requirements, CalChamber offers a PAGA Wage and Hour Compliance Toolkit, which contains access to PAGA-related webinar recordings, wage and hour policies, and more than 40 wage and hour forms, including a comprehensive payroll audit checklist.

Erika Barbara, Senior Employment Law Counsel, CalChamber

CalChamber members can also use the Wage and Hour Guide to access resources related to the most common wage and hour topics that employers must comply with. Not a member? See how CalChamber can help you.